On May 17th, 2024, the Transnational Taxation Network (TTN) and the International Law Section of the Florida Bar held a successful conference organized by Harper Meyer Partner Jeff Hagen at the renowned Rubell Museum in Miami, Florida, bringing together legal experts from various fields and parts of the world to explore and discuss matters in international taxation with a focus on art. The event saw participation from many accomplished attorneys, including various Harper Meyer attendees, who had the opportunity to participate in multiple lectures to explore subjects ranging from tax implications of art transactions to legal frameworks that govern art valuation and disposition.

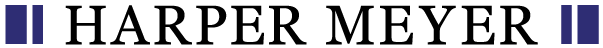

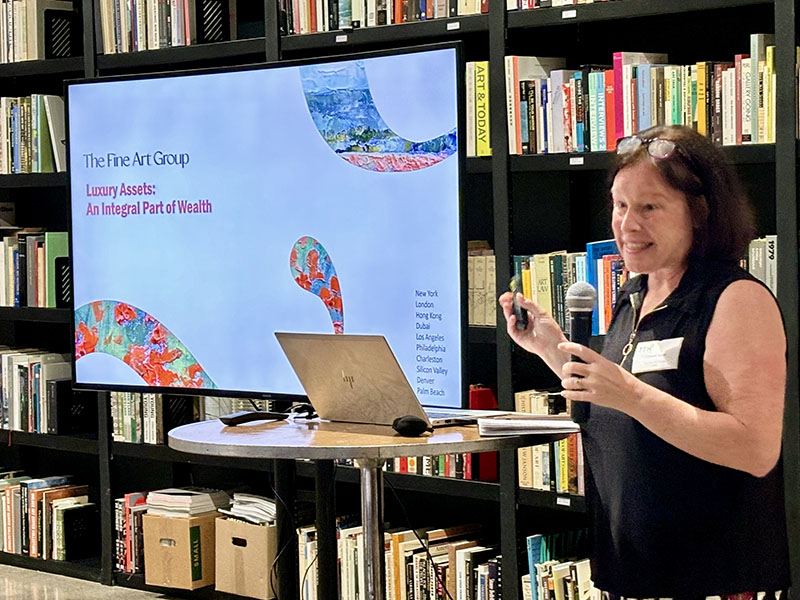

Topics explored included matters revolving around luxury asset management and the specific tax implications involved, in which attorneys emphasized the importance of understanding the legal and financial nuances to optimize tax benefits while ensuring compliance with regulations. Another session shed light on charitable giving tax strategies, where experts detailed the processes that can provide significant tax relief while promoting philanthropy. Additionally, the conference covered the transfer and taxation of art, highlighting the various methods to manage art collections efficiently. This included discussions on estate planning and the challenges of valuing art for tax purposes, where attorneys provided comprehensive strategies to minimize liabilities.

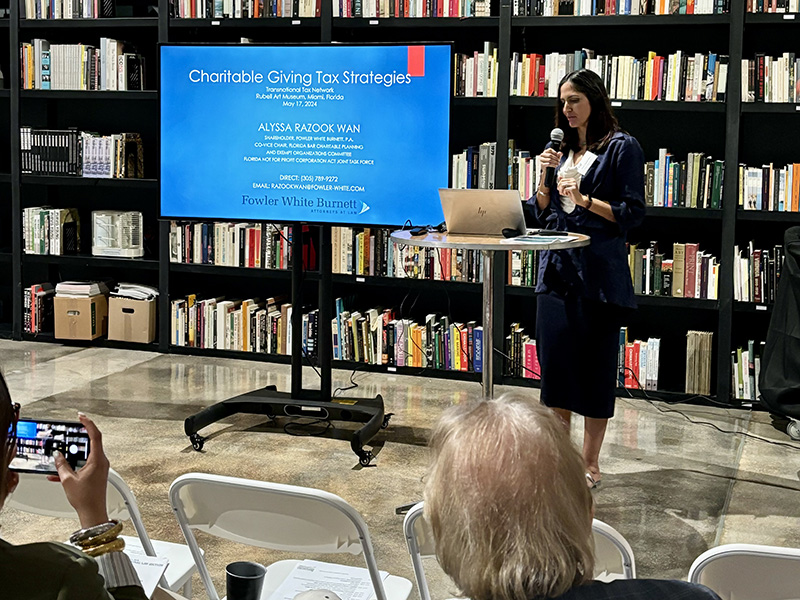

A standout presentation, imparted by Harper Meyer Partners Clarissa Rodriguez and Jeff Hagen, centered on the restitution of Nazi-looted stolen art, the Woman in Gold, and its tax effects, which delved deeply into the historical, legal, and fiscal complexities involved in returning art to its rightful owners.

Overall, the conference underscored the crucial role of interdisciplinary dialogue in tackling the multifaceted challenges of art taxation, leaving attendees better prepared to navigate these complex fields.

Harper Meyer wishes to congratulate Partner Jeff Hagen for leading such a successful conference and looks forward to future collaborations in advancing the understanding and practice of international taxation and Art Law.